It is not hard to find commentary on the internet indicating that Bitcoin is bound to fail. But there is no reason to think that cryptocurrencies will disappear.

Is Bitcoin doomed to failure? It is not hard to find commentary on the internet indicating that Bitcoin is bound to fail. The authors invariably point to aspects of Bitcoin’s implementation today and argue that the current state is not consistent with success.

I take these comments about Bitcoin as comments about private cryptocurrencies more generally and will treat them that way.

It is hard to foresee Bitcoin’s future. Ken Olsen said that “there is no reason for any individual to have a computer in his home” in 1977. It is easy to square that statement with computers of the day. Few would have found it worthwhile to have a computer in a dedicated computer room at a controlled temperature of about 65 degrees with backup power to avoid catastrophic damage. The statement is ridiculous in light of the computers in many people’s pockets today. A Samsung S8 is over 20 times more powerful than supercomputers of that day.

Many aspects of Bitcoin and cryptocurrencies more generally are likely to change in the coming decades. There is no reason to think that innovation in cryptocurrencies stopped with the creation of Bitcoin. There are issues. But it is not a large stretch of imagination to imagine some or all of them will be resolved in various ways.

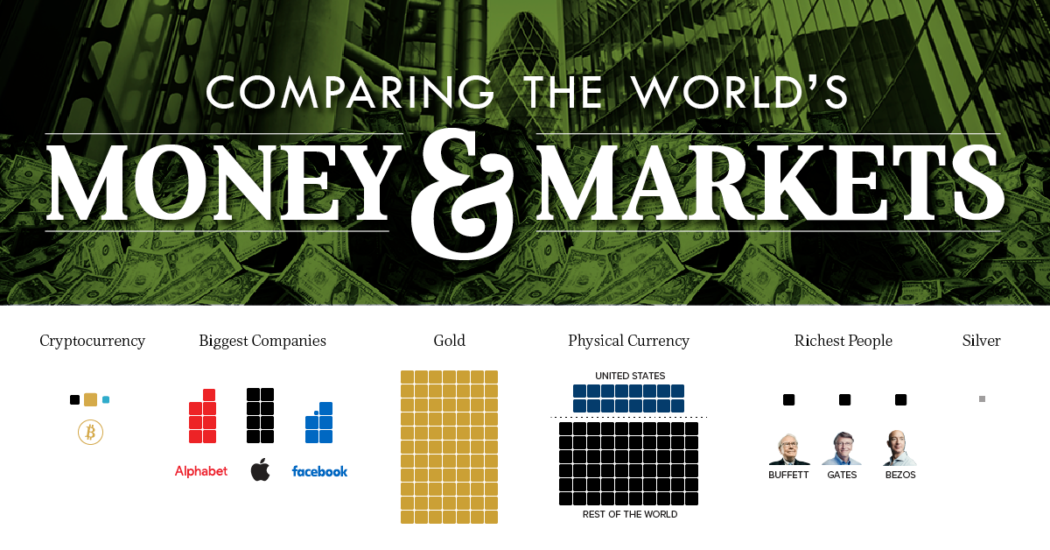

It is fair to say that cryptocurrencies are not obviously likely to replace, for example, the dollar used in transactions in the United States given reasonably good monetary policy, a point made by Will Luther, for example. There is no obvious gain to people in the United States from changing to a different currency to buy groceries. A currency has to have problems such as hyperinflation in Venezuela for cryptocurrencies to become viable for use on a regular basis. Cryptocurrencies also are a good way to circumvent capital controls.

That said, it also is true that the current incarnation of Bitcoin has issues if it is to become a currency in common use anywhere. “Scalability” is a term that summarizes many of these issues. The number of separate transactions on Bitcoin’s blockchain is quite limited. The maximum number of Bitcoin transactions is currently capped at about 400,000 per day. This is trivial compared to the number of transactions that Visa processes, about 150,000,000 per day.

The amount of electricity used in Bitcoin’s proof-of-work mining algorithm is as much as some small countries use. A further substantial increase in electricity use would be a large increase in the demand for electricity worldwide.

Both of these things are problems remaining to be solved.

Source/More: Cryptocurrencies Are Here to Stay | AIER