During the last months we have been hard at work with several liquidity partners to fulfill the promise of Security Tokens, or Digital Securities as we prefer to call them.

Our team is working with these partners to integrate the mechanisms of Securitize’s Digital Securities Protocol (DS Protocol) within their platforms. Our protocol provides a guarantee to issuers that the required control mechanisms (due to regulatory and business reasons) are enforced during trades and it does so automatically and in a decentralized way using smart contracts on a public blockchain (Ethereum in this case).

Decentralized Compliance is the Key

Earlier this year, Templum announced that it was to be the first company to execute a secondary market Security Token transaction of Blockchain Capital’s BCAP token. Given our intimate knowledge of the BCAP token (the original version, and not the current one upgraded with our protocol), we well know that this was not done using a decentralized compliance protocol on the blockchain, so the approval and necessary checks were presumably done manually.

What we will show you here is the first ever usage of a Security Token protocol to approve a trade on an exchange. The compliance checks for this exchange were run on the blockchain in a completely automated and decentralized way, implementing Securitize’s Digital Securities (DS) Protocol’s set of smart contracts. The trades were done in two different marketplaces — two of the many that are integrating our compliance protocol. Please note that while some exchanges choose to use their own internal protocols for compliance, the advantage of using an independent one (like ours) is that the same token can be issued with a single protocol, and traded compliantly on multiple exchanges simultaneously, which will increase liquidity for issuers. We believe that, as in capital markets today, the role of the exchanges versus the role of the so-called transfer agents (which in this case are just protocols on the blockchain for Security Tokens, decentralized transfer agents) will be delineated. A protocol (transfer agent) that is proprietary in one exchange is less likely to be adopted by competing exchanges.

Trading via Open Finance Network

We started working with Open Finance Network (OFN) back in May and have integrated the DS Protocol into their system. Thanks to the integrations made, we have now seen how an investor who onboards and runs KYC checks via the OFN platform can be cleared into the Registry Service associated with a DS Token. We saw this happen with the SPiCE VC Token, and it was possible because SPiCE VC “trusted” OFN via the DS Protocol to execute.

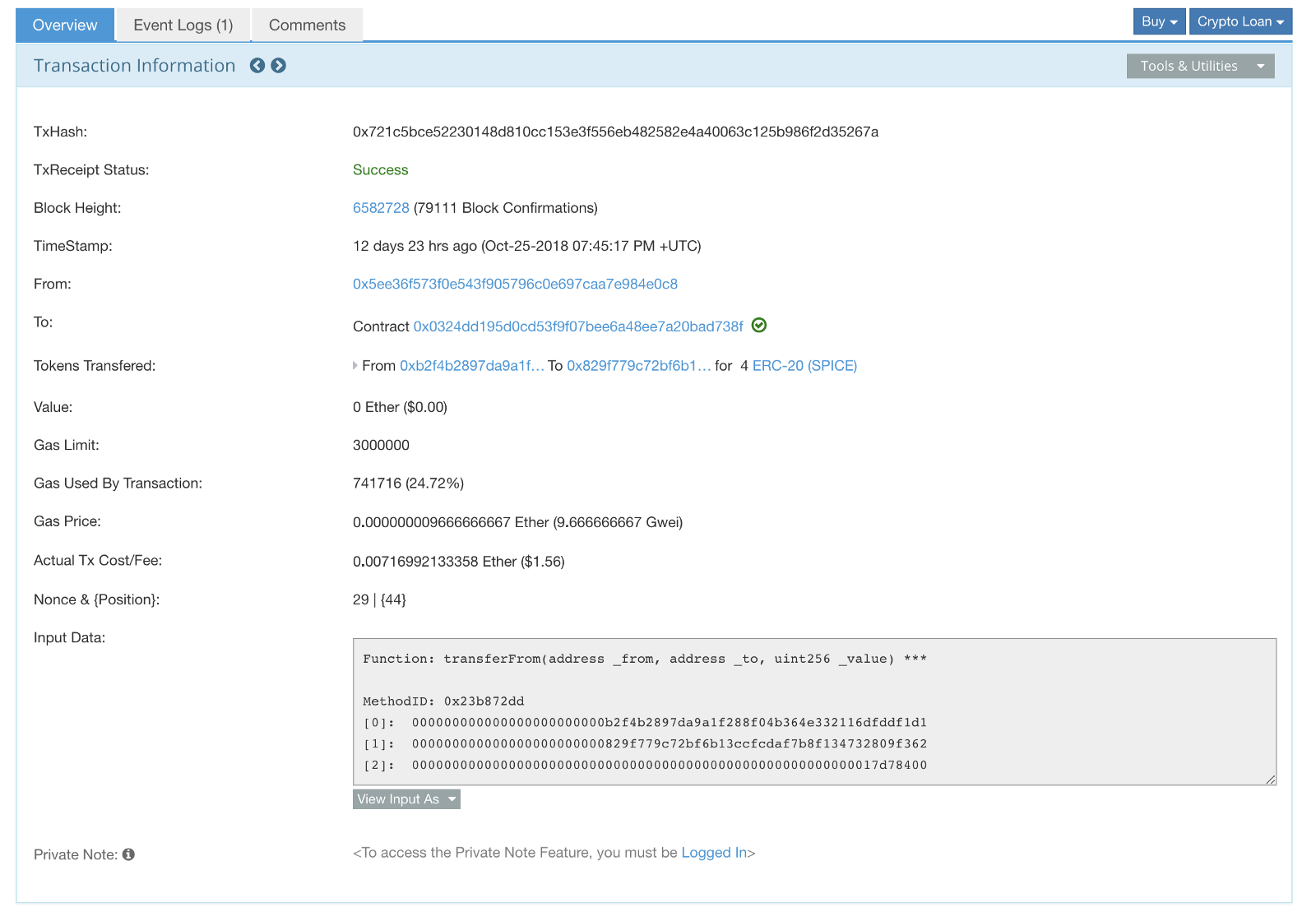

With this possibility, a new investor is able to buy SPiCE VC Tokens from other investors selling them. The OFN platform matches such orders and clears them via the transferFrom() method in the DS Token (a standard ERC20 method since we are ERC20 compatible). The DS Protocol then checks not only that both parties in the transaction are in the Registry Service (what would be a basic whitelisting), but also that the current context and the parties’ categories allow such a transfer to happen. Note here that simply creating whitelists of investors on a contract is not enough to run a decentralized compliance protocol; you also must check compliance rules and investor limits in real time.

The approved transfer will move tokens from one party’s wallet to the other’s.

Source/More: First ever Security Tokens traded with a decentralized compliance protocol