While cryptocurrencies have generated the lion’s share of investment and attention to date, I’m more excited about the potential for another blockchain-based digital asset: security tokens.

Security tokens are defined as “any blockchain-based representation of value that is subject to regulation under security laws.” In other words, they represent ownership in a real-world asset, whether that is equity, debt or even real estate. (They also encompass certain pre-launch utility tokens.)

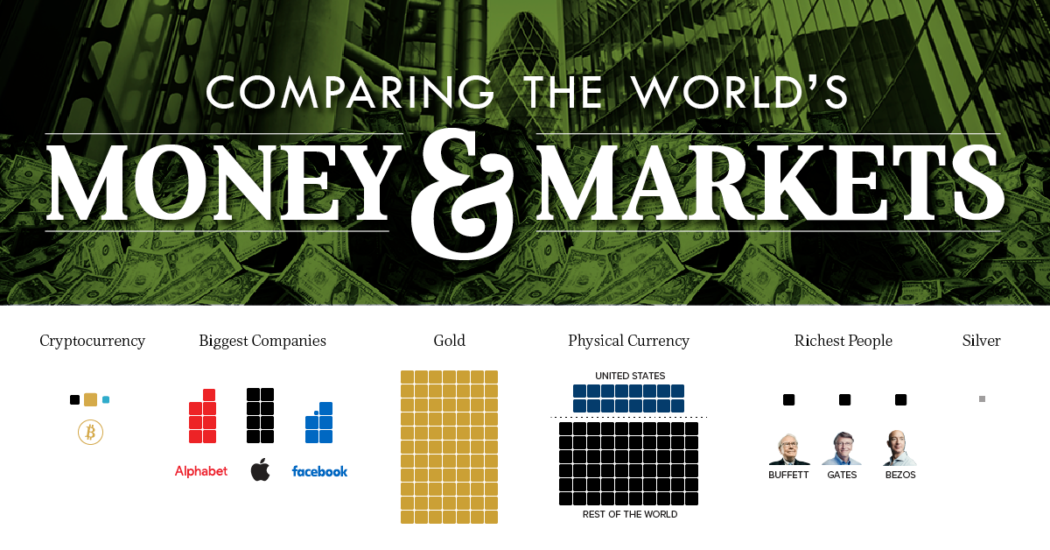

With $256 trillion of real-world assets in the world, the opportunity for crypto-securities is truly massive, especially with regards to asset classes like real estate and fine art that have historically suffered from limited commerce and liquidity. As I’ve written previously, imagine if real estate was tokenized into security tokens that you could trade as safely and easily as you do stocks. That’s where we’re headed.

There’s a lot of forward momentum around tokenized securities, so much so that based on their current trajectory, I believe security tokens are going to become a common part of Wall Street parlance in the near future. Investors won’t just be able to buy and sell tokens on mainstream exchanges, however; “crypto-native” companies are also throwing their hats into this ring.

The starter pistol has been fired

The race is on to bring security tokens to the masses.

Because Bitcoin and other cryptocurrencies are not classified as securities, it’s been much easier to facilitate trading on a large scale. Security tokens are more complex, requiring not just capabilities around trading, but also issuance and, critically, compliance. (See more of my thoughts on compliance here.) It’s a major undertaking, which is why we haven’t seen the Coinbase or Circle of security token trading emerge yet (or seen these companies expand their platforms to address this — more on that later).

Meanwhile, regular exchanges are blazing the trail and moving into providing tokens trading. The founder and chairman of the company that owns the NYSE announced a new venture, Bakkt, that would provide an on-ramp for institutional investors interested in purchasing cryptocurrencies. Last month, the SIX Swiss Exchange — Switzerland’s principal stock trading exchange — announced plans to build a regulated exchange for tokenized securities. The trading and issuing platform, SIX Digital Exchange, will adhere to the same regulatory standards as the non-digital exchanges and be overseen by Swiss financial regulators.

This announcement confirms a few things:

-

Most assets (stocks, bonds, real estate, etc.) will be tokenized and supported on regulated trading platforms.

-

Incumbents like SIX have a head start due to their size, regulatory licensing and built-in user base. They are likely to use this advantage to defend their position of power.

-

Most investors will never know they are using distributed ledger technology, let alone trading tokenized assets. They will simply buy and sell assets as they always have.

I expect other major financial exchanges to follow SIX’s lead and onboard crypto trading before long. I can imagine them salivating over the trading fees now, Homer Simpson-style.

Source/More: Security tokens will be coming soon to an exchange near you | TechCrunch