ICO Quality: Development & Trading

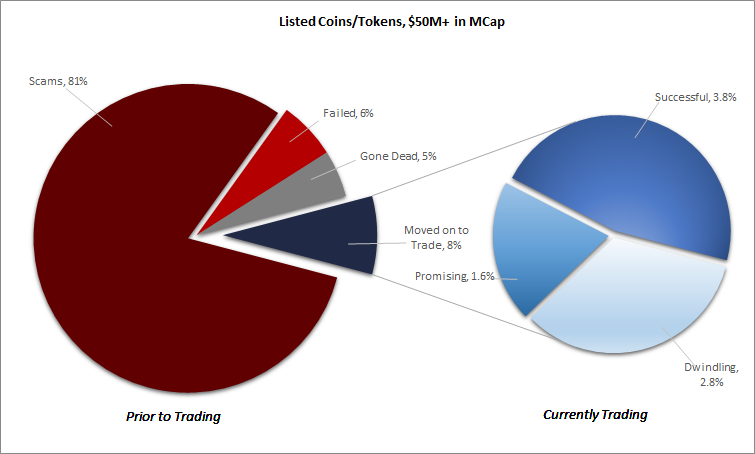

In a recent study, we’ve attempted to classify ICO’s by quality. This encompasses the lifecycle of an ICO, from the original proposal of fundraising availability through to the most mature phase of trading on a cryptocurrency exchange (also known as “online trading platforms”) (“exchange”). This is a high level look above a market cap of $50M only, as an initial attempt to improve on the reporting we have seen to date on percentage failed ICO’s. We will continue to develop our research in this area and produce a more in-depth study in coming months.

We break down ICO’s into groups, with the following definitions:

· Scam (pre-trading): Any project that expressed availability of ICO investment (through a website publishing, ANN thread, or social media posting with a contribution address), did not have/had no intention of fulfilling project development duties with the funds, and/or was deemed by the community (message boards, website or other online information) to be a scam.

· Failed (pre-trading): Succeeded to raise funding but did not complete the entire process and was abandoned, and/or refunded investors as a result of insufficient funding (missed soft cap).

· Gone Dead (pre-trading): Succeeded to raise funding and completed the process, however was not listed on exchanges for trading and has not had a code contribution in Github on a rolling three-month basis from that point in time.

· Dwindling (trading): Succeeded to raise funding and completed the process, and was listed on an exchange, however had one or less of the following success criteria: deployment (in test/beta, at minimum) of a chain/distributed ledger (in the case of a base-layer protocol) or product/platform (in the case of an app/utility token), had a transparent project roadmap posted on their website, and had Github code contribution activity in a surrounding three-month period (“Success Criteria”).

· Promising (trading): Two of the above Success Criteria.

· Successful (trading): All of the above Success Criteria.

On the basis of the above classification, we found that approximately 81% of ICO’s were Scams, ~6% Failed, ~5% had Gone Dead, and ~8% went on to trade on a exchange.

Source/More: ICO Quality: Development & Trading – Satis Group – Medium