The basis of this admittedly crazy forecast was simple: capital flows

I think we can all agree that bitcoin (BTC) is “interesting.” One of the primary reason that bitcoin (and cryptocurrency in general) is interesting is that nobody knows what will happen going forward.

Unknowns and big swings up and down are characteristics of open markets.It’s impossible to forecast bitcoin’s future price because virtually all the future inputs are unknown.

We’ve lived so long with managed markets that only loft higher that we’ve forgotten that unmanaged markets are volatile and full of unknowns. We’ve forgotten that markets are reflections of all sorts of things, from human emotions to herd behavior to changes in the underlying Mode of Production, i.e. how stuff gets done, made, distributed and paid for.

Last May, when bitcoin was around $580, I distributed a back-of-the-envelope forecast of $17,000 per bitcoin to my subscribers and patrons ($5/month or $50 annually). (In June, I presented the case to subscribers of PeakProsperity.com, where I’m a contributing writer.)

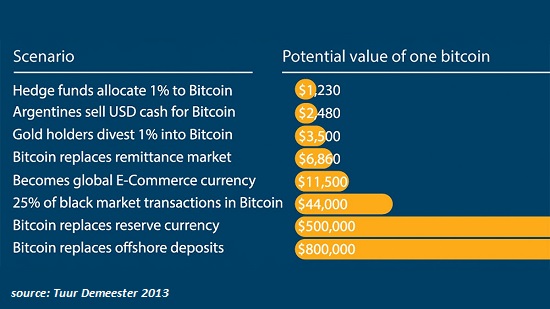

The basis of this admittedly crazy forecast was simple: capital flows. There is around $300 trillion in financial “wealth” sloshing around the global economy, and another $200 trillion in real estate. (The sum of financial wealth is now much higher, due to the extraordinary gains in global markets.) I reckoned that if a tiny slice of that financial wealth flowed into bitcoin–1/10th of 1%– the inflow of capital would push bitcoin to around $17,000 per coin.

If 1% of all that wealth sloshing around looking for yield and safety decided to find a home in bitcoin, the forecasted price was an insane $170,000.

Compared to this, $17,000 per BTC looked almost conservative. But since bitcoin was under $600 at the time, $17,000 looked pretty darn crazy. But the math looked compelling to me: $300 trillion in mostly mobile capital sloshing around an inherently unstable system, and little old bitcoin was worth a meager $9 billion. Given that the total number of bitcoin was limited to 21 million, it didn’t seem much of a stretch to imagine a tiny sliver of all that capital flowing into BTC.

I heard many reasons why my scenario didn’t hold water. Fair enough: the future is unknown, I could have been completely wrong, and BTC could have dropped back to $60 or $6.

I repeated my analysis to my subscribers and patrons in December 2016, when BTC had reached $900.

So now we know bitcoin didn’t go to $60, or zero; it has climbed to $9,500 or so, a bit over halfway to my rough and unsophisticated back-of-the-envelope forecast of $17,000. Could BTC suddenly drop to $7,000? Of course it could; given its history, we should expect dizzying declines of up to 30% or more.

The interesting thing to me is that nobody knows what will happen going forward. Not knowing is refreshing. So is the opportunity to be right or wrong. This is what investing is supposed to be about.

There are all sorts of scenarios out there. Some will be right, some will be wrong, some will be half-right, and in all likelihood, stuff will happen that nobody predicted.

Source/More: oftwominds-Charles Hugh Smith: My Crazy $17,000 Target for Bitcoin Is Looking Less Crazy